Nov 10, 2023A period cost is any cost that cannot be capitalized into prepaid expenses, inventory, or fixed assets.A period cost is more closely associated with the passage of time than with a transactional event. Since a period cost is essentially always charged to expense at once, it may more appropriately be called a period expense. A period cost is charged to expense in the period incurred.

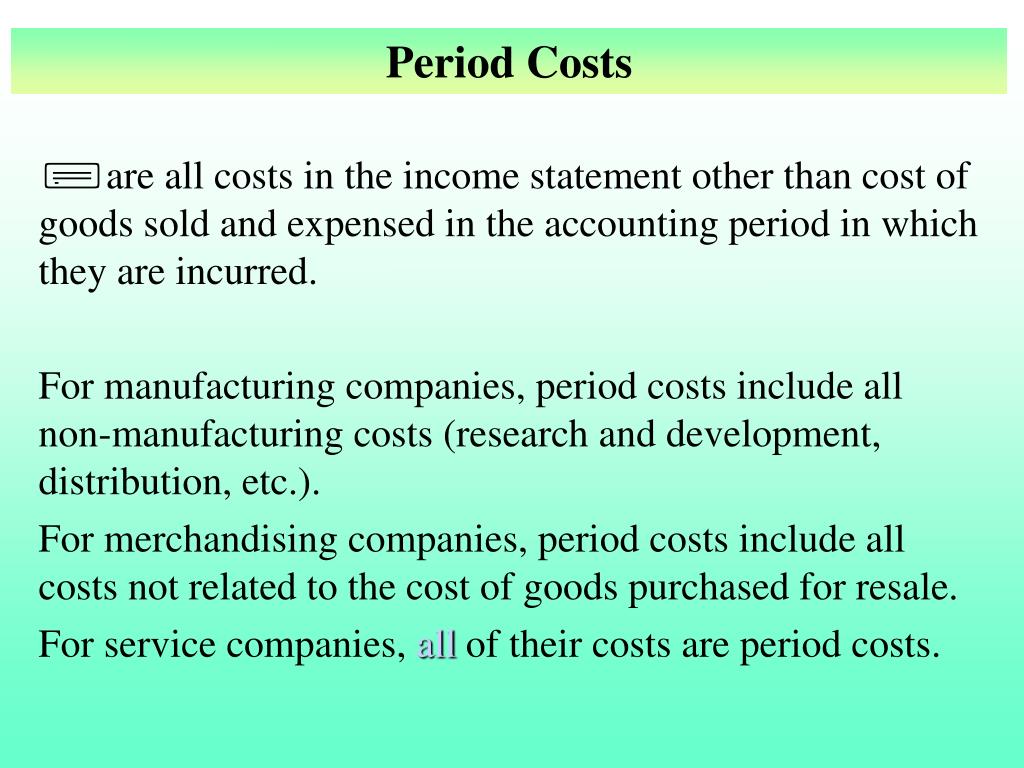

PPT – Inventoriable costs and period costs PowerPoint Presentation, free download – ID:332077

Sep 22, 2023question No one rated this answer yet — why not be the first? 😎 rohitrana27 Final answer: Option 4: Cost of raw materials is NOT a period cost. Period costs are those expenses that are not directly tied to production and are expensed in the period they are incurred, like sales commissions and interest expense.

Source Image: blog.hootsuite.com

Download Image

Apr 7, 2022Period costs are all costs not included in product costs. Period costs are not directly tied to the production process. Overhead or sales, general, and administrative (SG&A) costs are considered

Source Image: acarchitects.biz

Download Image

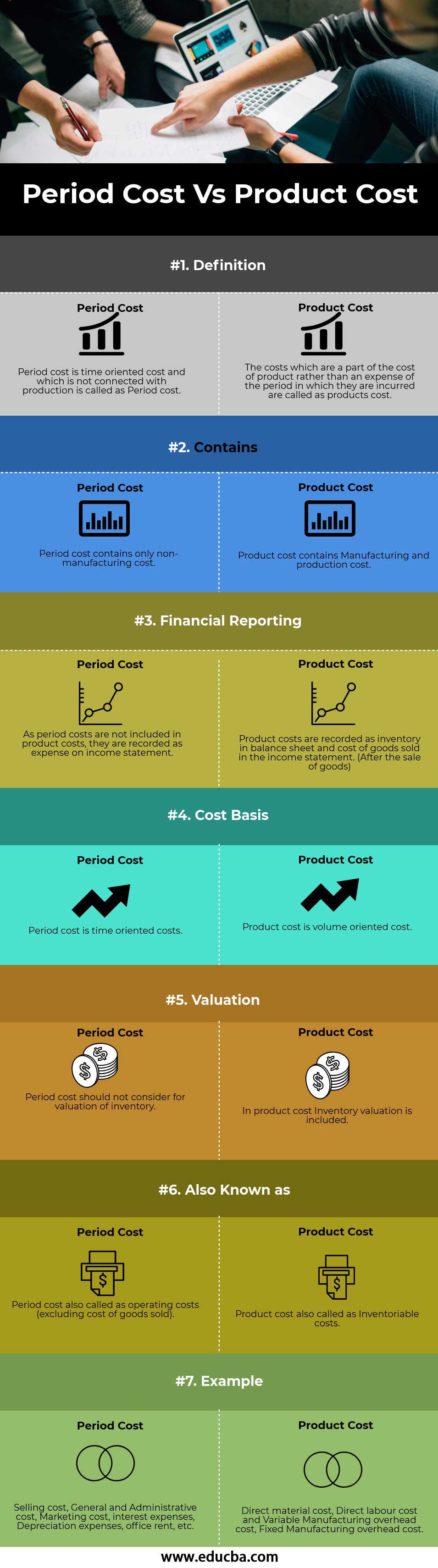

Period Cost Vs Product Cost | 7 Most Valuable Differences To Learn Unlock Previous question Next question Transcribed image text: Which of the following would not be a period cost? Product costs consist of Not the question you’re looking for? Post any question and get expert help quickly. Start learning Answer to Solved Which of the following would not be a period cost? | Chegg.com

Source Image: educba.com

Download Image

Which Of The Following Is Not A Period Cost

Unlock Previous question Next question Transcribed image text: Which of the following would not be a period cost? Product costs consist of Not the question you’re looking for? Post any question and get expert help quickly. Start learning Answer to Solved Which of the following would not be a period cost? | Chegg.com Period Cost Definition. According to the Corporate Finance Institute, period costs are defined as follows: Period costs are costs that cannot be capitalized on a company’s balance sheet. In other words, they are expensed in the period incurred and appear on the income statement. Period costs are also called period expenses.

Period Cost Vs Product Cost | 7 Most Valuable Differences To Learn

Period costs are also called period expenses. Understanding Period Costs In managerial and cost accounting, period costs refer to costs that are not tied to or related to the production of inventory. Examples include selling, general and administrative (SG&A) expenses, marketing expenses, CEO salary, and rent expense relating to a corporate office. Pinterest – Wikipedia

Source Image: en.wikipedia.org

Download Image

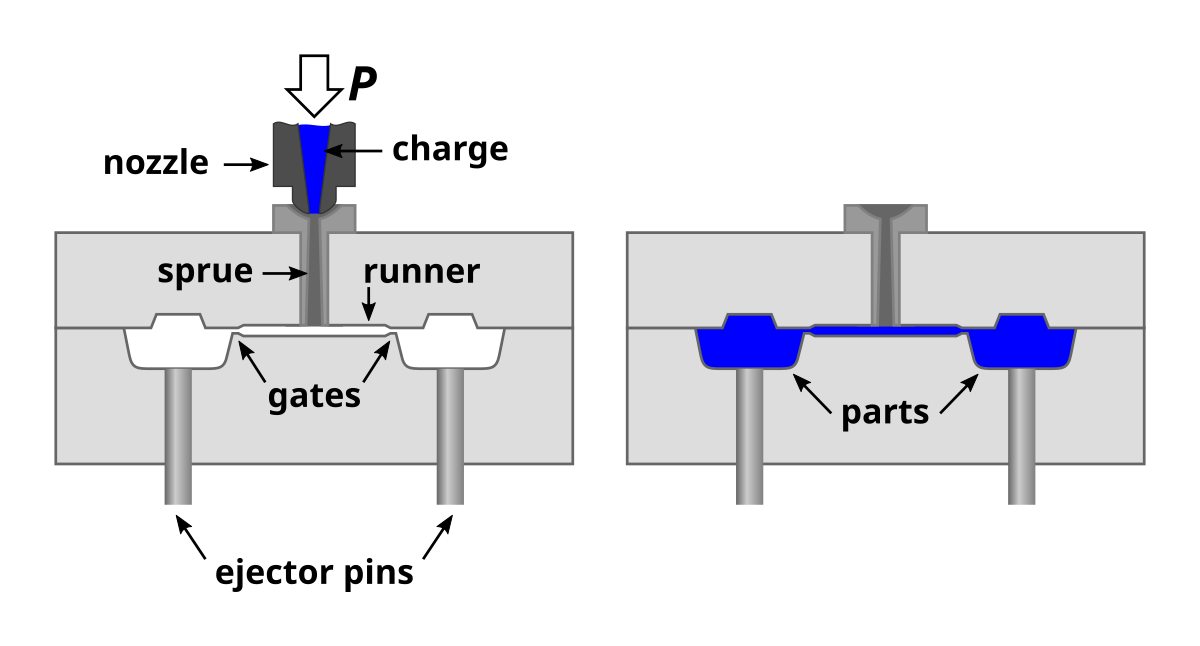

Injection moulding – Wikipedia Period costs are also called period expenses. Understanding Period Costs In managerial and cost accounting, period costs refer to costs that are not tied to or related to the production of inventory. Examples include selling, general and administrative (SG&A) expenses, marketing expenses, CEO salary, and rent expense relating to a corporate office.

Source Image: en.wikipedia.org

Download Image

PPT – Inventoriable costs and period costs PowerPoint Presentation, free download – ID:332077 Nov 10, 2023A period cost is any cost that cannot be capitalized into prepaid expenses, inventory, or fixed assets.A period cost is more closely associated with the passage of time than with a transactional event. Since a period cost is essentially always charged to expense at once, it may more appropriately be called a period expense. A period cost is charged to expense in the period incurred.

Source Image: slideserve.com

Download Image

Period Cost Vs Product Cost | 7 Most Valuable Differences To Learn Apr 7, 2022Period costs are all costs not included in product costs. Period costs are not directly tied to the production process. Overhead or sales, general, and administrative (SG&A) costs are considered

Source Image: educba.com

Download Image

UMEDA SKY BUILDING/KUCHU TEIEN OBSERVATORY 1. Which of the following statements about period costs is true? a. Period costs are included in inventories on the balance sheet. b. Period costs are included in cost of goods sold on the income st; If the Cost of Goods Sold was understated in Period 1, then the Cost of Goods Sold and gross profit in Period 2 will be: A. both understated.

Source Image: skybldg.co.jp

Download Image

What is period cost and how does it differ from product cost? – Quora Unlock Previous question Next question Transcribed image text: Which of the following would not be a period cost? Product costs consist of Not the question you’re looking for? Post any question and get expert help quickly. Start learning Answer to Solved Which of the following would not be a period cost? | Chegg.com

Source Image: quora.com

Download Image

Adidas Sales Analysis: Unveiling Insights through Data-driven Exploration and Visualization. | by Williams Nse Idara | Medium Period Cost Definition. According to the Corporate Finance Institute, period costs are defined as follows: Period costs are costs that cannot be capitalized on a company’s balance sheet. In other words, they are expensed in the period incurred and appear on the income statement. Period costs are also called period expenses.

Source Image: medium.com

Download Image

Injection moulding – Wikipedia

Adidas Sales Analysis: Unveiling Insights through Data-driven Exploration and Visualization. | by Williams Nse Idara | Medium Sep 22, 2023question No one rated this answer yet — why not be the first? 😎 rohitrana27 Final answer: Option 4: Cost of raw materials is NOT a period cost. Period costs are those expenses that are not directly tied to production and are expensed in the period they are incurred, like sales commissions and interest expense.

Period Cost Vs Product Cost | 7 Most Valuable Differences To Learn What is period cost and how does it differ from product cost? – Quora 1. Which of the following statements about period costs is true? a. Period costs are included in inventories on the balance sheet. b. Period costs are included in cost of goods sold on the income st; If the Cost of Goods Sold was understated in Period 1, then the Cost of Goods Sold and gross profit in Period 2 will be: A. both understated.