A Quarter a Day: How Much Is It Really?

Have you ever heard the saying “a quarter a day keeps the doctor away”? While the accuracy of this claim is debatable, it’s a catchy phrase that illustrates the power of small, consistent actions over time. Imagine if you set aside just a quarter, or 25 cents, every day for a year. How much money would you have at the end?

If you’re curious, let’s do the math together.

The Power of Compounding

Before we delve into the calculation, it’s worth understanding the concept of compounding interest. Compounding is the phenomenon where interest is earned on both the original principal amount and the interest accumulated over time. In other words, your money grows exponentially rather than linearly.

While we won’t consider interest in this case, the same principle applies to any regular savings plan. The more you save consistently, the greater the total amount accumulates over time.

Calculating a Quarter a Day

Now, let’s calculate how much a quarter a day for a year would amount to. There are 365 days in a year, so you would save 365 quarters.

365 quarters x 25 cents/quarter = $91.25That’s right, by saving just a quarter a day, you would have accumulated $91.25 at the end of the year. It may not seem like much, but it’s a significant amount considering the small daily contribution.

Breaking It Down Further

Let’s break down the calculation further to illustrate the impact of compounding.

- Week 1: 7 quarters = $1.75

- Month 1: 31 quarters = $7.75

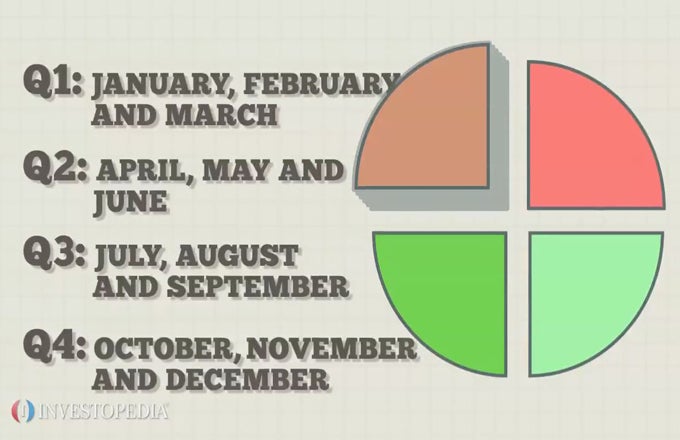

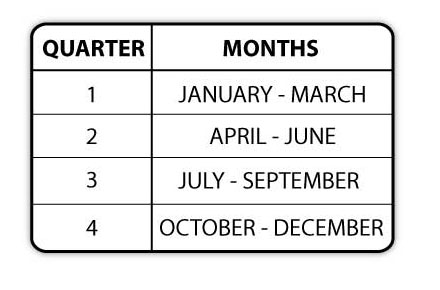

- Quarter 1: 91 quarters = $22.75

- Half Year: 182 quarters = $45.50

- Year: 365 quarters = $91.25

As you can see, the savings grow steadily over time, thanks to the consistent daily contributions.

Tips for Success

If you’re inspired to start saving a quarter a day, here are a few tips to help you succeed:

- Set a specific time each day to put away your quarter.

- Keep a jar or box designated for your savings.

- Automate the process by setting up a recurring transfer from your checking to a savings account.

- Reward yourself for your consistency.

Remember, the key is to be consistent and make saving a habit. Even small amounts add up over time, so don’t underestimate the power of a quarter a day.

FAQs

Here are some common questions related to saving a quarter a day:

- Q: Is it really worth saving just a quarter a day?

- A: Yes, it is. While it may not seem like much, it’s a great way to start building a savings habit and accumulate a significant amount over time.

- Q: What are some ways to use the money I save?

- A: You can use the money for emergencies, future expenses, or even invest it for long-term growth.

- Q: What if I miss a day of saving?

- A: Don’t worry, just get back on track as soon as possible. Consistency is key, but small setbacks won’t derail your progress.

Conclusion

Saving a quarter a day may seem like a small step, but it can lead to significant financial gains over time. By embracing the power of consistency and compounding, you can build a solid financial foundation for yourself and your future. Are you ready to start your quarter-a-day savings journey today?

Image: www.ohio-unemployment.org

Image: www.splashmath.com

excel – Calculating number of days per quarter for two dates – Stack … In the third quarter of 2023, the average salary of a full-time employee in the U.S. is $1,118 per week, which comes out to $58,136 per year. While this is an average, keep in mind that it will vary according to many different factors. … New Year’s Day, Birthday of Martin Luther King Jr. February: Washington’s Birthday: May: Memorial Day